Back in the news today - and as so often recently, for all the wrong reasons - is driver and rider matching service Uber, which, as I’ll post later, has been revealed to have been seriously economical with the actualité in its dealings with Transport for London. But of more immediate concern to the successors of modern-day Vanderbilt Travis Kalanick have been proceedings in the European Court of Justice.

The BBC has reported “Uber is officially a transport company and not a digital service, the European Court of Justice (ECJ) has ruled. [Uber] argued it was an information society service - helping people to make contact with each other electronically - and not a cab firm. The case arose after Uber was told to obey local taxi rules in Barcelona. Uber said the verdict would make little difference to the way it operated in Europe”.

Not make a difference? Hold that thought for a moment. Let’s look at the verdict: “In its ruling, the ECJ said that a service whose purpose was ‘to connect, by means of a smartphone application and for remuneration, non-professional drivers using their own vehicle with persons who wish to make urban journeys’ must be classified as ‘a service in the field of transport’ in EU law”. Or otherwise known as a statement of the obvious.

The Beeb has added that “Since Uber was first launched less than a decade ago, it has repeatedly fallen foul of regulators in different countries - and has frequently been forced to change its business model as a result … This ruling sets out clearly that Uber is, in legal terms at least, a transport company”. But something has been missed here.

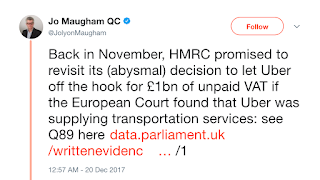

And that something is VAT. As Jo Maugham observed today, “Back in November, HMRC promised to revisit its (abysmal) decision to let Uber off the hook for £1bn of unpaid VAT if the European Court found that Uber was supplying transportation services”. He referred to evidence given by officials from HMRC to the Public Accounts Committee (see HERE).

Today, the ECJ did just that, as he noted: “The European Court has just found that Uber is supplying transportation services” (see judgment HERE). So he continues “I had previously expressed the view, on the basis of the evidence then before me, that HMRC was failing to apply the law in the case of Uber” (see blogpost HERE).

Maugham’s conclusion is as direct as it is damning: “I now have direct evidence of why HMRC is failing to apply the law to some US MNCs. I expect to be in a position to release that evidence shortly. Meanwhile, following today's CJEU decision, HMRC must surely apply the same law to Uber as it does to everyone else”. Meaning what, exactly?

Meaning that Uber in the UK should now be on the hook for a cool £1 Billion in unpaid VAT. And that’s before even considering the mess in which the company’s dishonesty and double dealing has landed its operations in London, and potentially several other cities. HMRC would not hesitate if the VAT was owed by a small business owner - like, for instance, a London cabbie - so perhaps it could display an equal zeal when it’s Uber.

Another rather large Uber chicken comes home to roost. Just in time for Christmas.

1 comment:

In a country of institutionalised far right corruption and immorality......what do you think are the chances of recouping such due taxes?

That's right: Fuck all.

Post a Comment