While the right-leaning part of the press continues its relentless Labour-bashing, reinventing yesterday’s manifesto launch in the most creative, and generally insulting, ways imaginable, the focus now shifts to the Tories, who have obligingly trailed one policy in which they, and their press pals, have clearly set great store, because it brings back memories of a happier time, when they were in power.

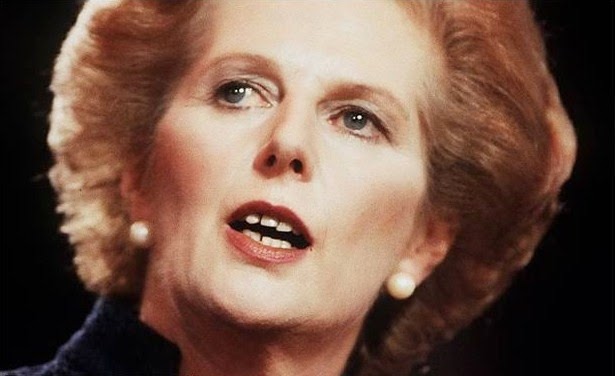

Remember her? The Tories are hoping you will

While the routinely sycophantic Telegraph proclaims “We are the true party of working people” (well, Young Dave and his jolly good chaps do employ so many of them), the Times gets straight to the point. “Right to buy for 1.3m families” it tells. Ah, the return of right to buy. The Mail is ecstatic. “Right to buy: a new revolution”. The Express has the real reason, though, with “Maggie’s right to buy dream is back”.

There is much use of the word “Maggie”, as witness the Mail’s “A new right to buy revolution: 35 years after Maggie's visionary policy, Cameron pledges property dream will become reality for 1.3million more families”. That would very much depend on 1.3 million tenants wanting to exercise whatever right the Tories confer on them. And the reality is that neither the Mail, nor the rest of the Tory cheerleaders, is being honest with readers.

In the 1980s, right to buy was a very good way of increasing economic activity through ramping up the stock of debt - without the public sector having to get involved. Those buying took out mortgages, then loans to improve and personalise their properties. DIY chains prospered; the service economy expanded. Self-employed builders, plasterers, joiners, plumbers, decorators: all benefited.

And the housing sold had been in local authority hands - in the public sector. It’s not so easy today, as much of that social housing has passed to housing associations. As David Orr, CEO of the National Housing Federation, has pointed out, these are invariably charitable organisations who have borrowed money to build and improve homes, and who depend on the revenue stream called rental income to service their debt.

Forcing them to flog their portfolios at a discount would screw them over royally - unless the Government sees them right. And how much will that cost? You’re right - we don’t get to find that out. And how about that replacement of homes sold on a one for one basis? Well, since 2012, it’s not happened: Jason Beattie at the Mirror has pitched figures of 17,205 sold versus a paltry 820 built. That’s not good enough.

[UPDATE 1715 hours: the Tories' measure has been awarded the thumbs-down across the political spectrum: at Londonist, Rachel Holdsworth tells that the plan "Would be a disaster for London". Julia Hartley Brewer, writing at the Telegraph, calls the proposals "Economically illiterate and morally wrong".

Sky News' Faisal Islam reports the National Housing Association's calculation that just 220,000 of the mooted 1.3 million tenants would be able to get mortgages. Politics Home has pointed out that London's occasional Mayor Alexander Boris de Pfeffel Johnson gave the idea the thumbs-down, explaining that it would need "massive subsidies".

Jim Pickard reports the CBI as warning "Extending the Right to Buy scheme doesn’t solve the problem of boosting the supply of affordable homes". This supposedly key commitment has not survived until the evening rush-hour, with threats of legal action being mooted if housing associations are forced to sell by a future Government. Someone at CCHQ is not thinking all of this through]

3 comments:

There is a relatively simple way to increase the stock of truly affordable (i.e. Council) housing.

Local and national government own thousands of hectares of land suitable for building new homes. There are even more hectares of agricultural land adjoining existing towns and cities. Post-WW2 such agricultural land was acquired cheaply and permission changed to allow housebuilding. The same could happen again.

Once the land is identified, councils or housing associations should then be allowed to go to markets to borrow for the cost of building the new homes. There are institutional investors like insurance companies and pension schemes that look for long-term returns that rental could provide. If councils are not allowed to borrow to build, then the land could be leased, long-term (<99 years) on peppercorn rents. Once built, these homes should be rented at a rate that reflects cost + maintenance and not on "market" rates.

There would a stimulus to the economy from increased REAL employment and the necessity to buy furniture and equipment to furnish the homes. This would be reflected in a reduction in out of work and in-work benefits. As the homes are rented out, we should also see a reduction in Housing Benefit too. The lower rents would have a knock-on effect in lowering the rents of privately rented accommodation, offering further reductions to the Housing Benefit bill.

Of course there would be a downside. Those who rushed into Buy to Let may find that their investments may not be returning what they had hoped. Some BtL landlords may even find themselves in negative equity. This could also transfer to the general housing market, as more properties become available for sale, the price (value) should drop. But as we are always warned, "markets can go down as well as up". So tough!

Right to Buy has given a false boost to house (in reality - land) prices, this would go some way to mitigating that effect and may possible lead to home ownership being seen as somewhere to live, as opposed to an investment to be profited from.

One tiny problem with that.

Ask people if there is a problem with the property Market, most will say yes.

Ask them if the Market is stacked against first time buyers, they will say yes.

Ask if we need more affordable housing stock, yes again.

Now ask if they'd be happy to see their own house drop in value.

That's the elephant in the room.

Am I imagining something or did I hear Dave mention something some months ago about limiting new tenants right to open ended tenancies? Weren't they going to be limited to just a few years? In which case how would they build up their right to buy?

Post a Comment